The Second wave of the Coronavirus is jeopardizing the world economy. The spread of the coronavirus infection and widening COVID-19 Restrictions in the United States and other parts of the world has hampered fuel demand.

Weaker global equities amid growing concerns over the upsurge of the pandemic also cushioned the fears over slowing consumption and demand.

Oil prices backwardated (trended lower in futures markets) earlier this year but are heading into a steady upward slope or contango in the near future even though oil markets seem to be settled at a point of convergence presently and will likely be stuck in this state for a few more months. Analysts speculate that international Brent oil price may stay within a narrow price band of between US$42 per barrel and US$45 per barrel till Q2 2021 on the assumption that there is no third wave of the coronavirus pandemic and that OPEC retains its present supply cut of 7.7m barrels per day.

Light at the End of the Tunnel

On Monday, November 16th 2020, Moderna, a global pharmaceutical company, claimed the Phase three study of its vaccine – which had enrolled more than 30,000 participants in the U.S. – had met a minimum acceptable statistical medical criteria with a vaccine efficacy of 94.5 percent, the news came a week after BioNTech and Pfizer announced a 90% efficacy for their own vaccine, both news spurred a bullish outlook for oil as crude prices jumped by 7.5% .

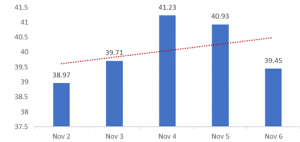

During the first week of November shortly before the vaccine announcement, Brent crude hit a week’s high on November 4th 2020, at US$41/bbl but after the vaccine news Brent rose to US$44/bbl in the third week of the month

Gold Slump

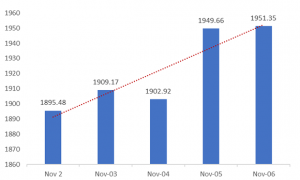

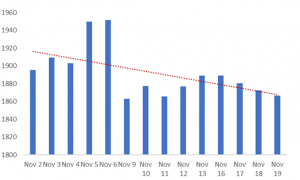

The Opposite could be said for Gold prices, just before the vaccine news Gold had a weekly growth of +2.9% closing the week at US$1,951.35/t.oz during the first week of November but after the vaccine news, the safe haven asset, slumped by 4.5% on the same day the vaccine news circulated hitting a month-to-date low of US$1,863.04/t.oz, with investors dumping the yellow metal for riskier assets.

The returning spring in the U.S. dollar also pressured the bullion. Typically, a strong US dollar makes gold more expensive for holders of the metal in other currencies

Voting for Vaccine Rather Than A Gold Rally

Global economies need a vaccine to help eliminate their worst enemy- the Coronavirus, even if this means that gold will lose some market value. While the demand and price of gold have fallen considerably in November 2020, investors are not complaining as a world economy chugging along nicely would more than compensate for a soaring price of yellow metal, which will continue to remain a delightful store of value.

source: proshareng

Recent Comments