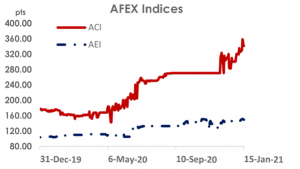

The AFEX Commodities Index continues its 4weeks bullish trend, increasing by 4.91% for the reporting week.

This increase could mostly be attributable to the increase in the price of maize, soybean and sorghum on the Exchange, Given the nature of grains in the country, prices are expected to continue on a bullish trend as local production is below local demand, especially for maize, as the commodity costs more in neighbouring countries like Niger and Benin thus suppliers are encouraged to smuggle the commodity for higher income.

The AFEX Export Index continues to remain bullish for the reporting week, as it experienced an uptick of 1.97% against the previous week, which was driven by the uptick in the price of cocoa despise the fall in ginger prices on the Exchange.

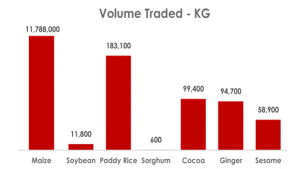

Total volume traded on the Exchange in KG during the week stood at 12.2million. Maize recorded 11.7million KG as the largest traded volume during the period, while sorghum recorded the lowest trade volume for the week as 600KG.

During the reporting week, maize closed at N177/KG increasing by 5.77% W-o-W, while paddy rice experienced the

largest price decline on the last trading day of the week (-5.70% W-o-W), closing at N181/KG for the reporting week. Soybean continues its bullish trend for the 2nd consecutive week since the start of 2021, increasing by about 17% as against the previous week, this is mostly attributable to the Demand-Supply dynamics of the commodity in the country as the highest producing regions (Benue, etc.) harvest was low due to inadequate rainfall.

Local indicative open market prices for maize, soybean, sorghum, ginger and sesame were higher than Exchange traded

prices. However, investors on the Exchange priced paddy rice and cocoa higher during the week under review.

Week-on-Week in the open market, maize prices increased by 7.66%. Similarly soybean, sorghum and ginger increased by 2.52, 7.01 and 4.57 percent respectively. Paddy rice by 1.25 percent, while cocoa and sesame remained the same as the previous week’s price in the open market.

Market Talk

Coarse grain prices are well above their year-earlier value as the effects of the 2020 harvest did not dip prices as much as expected. This is mainly as a result of the low harvest yield of 2020 and the supply chain bottleneck amid generally difficult macro-economic conditions (farmers insecurity) particularly in the northern regions of the

country.

Source: Proshareng

Recent Comments