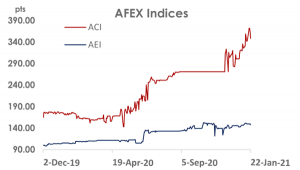

The AFEX Commodities Index continued its 5 week bullish trend, closing the week with a 1.96% increase from the previous week. This uptick was largely driven by the positive price surge in maize and soybean despite the continuous bearish trend of paddy rice. Maize and soybean continued their uptick in prices as the demand for the commodity significantly outweighed their supply in the country.

The AFEX Export Index closed the reporting week bearish, being the end of its 2 week bullish trend. It closed with a 1.34% decline on the reporting week. This decline is as a result of the price decline of cocoa and ginger on the Exchange, as the demand for the cocoa remains relatively low because of the lockdown restrictions of high demand regions like the UK.

Total volume traded on the Exchange in KG during the week stood at 435,788 contracts. Maize recorded 431,804 contracts as the largest traded volume during the period, while cocoa recorded the lowest trade volume for the week at 57 contracts.

During the reporting week, sorghum experienced the highest price surge, increasing by 8.53% W-o-W to close at N18,070/ contract. Sesame experienced the largest price decline closing the week with a 3.17% W-o-W decline. Maize and soybean continued their bullish trend, closing the reporting week with a 3.17% and 2.85% W-o-W price increase respectively. Both export commodities on the Exchange closed the week bearish, as both cocoa and ginger both experienced a 1.15% and 1.57% W-o-W price decline compared to the previous week.

Local indicative open market survey prices for maize, soybean, paddy rice, sorghum, ginger and sesame were higher than Exchange traded prices. However, investors on the Exchange priced cocoa higher during the week under review.

Week-on-Week in the open market, maize prices increased by 7.66%. Similarly, soybean, sorghum and ginger increased by 2.52, 7.01 and 4.57 percent, respectively. Paddy rice decreased by 1.25 percent, while cocoa and sesame remained the same as the previous week’s price in the open market.

Market Talk

The outlook for cocoa prices remains bearish as the effects of COVID-19 and the lockdown in high import countries for the commodity has caused Chocolate producing companies to adopt inventory management strategies to minimize their losses and remain profitable. There exists a large stock of the commodity in different warehouses in the southern regions of the country, indicating a larger demand compared to supply which usually precedes price decline.

Credit: Proshare

Recent Comments