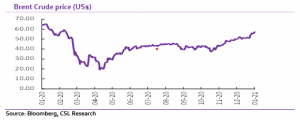

This morning, Brent crude price in the international market peaked at US$57.38/ barrel. This surge follows the recent announcement by Saudi Arabia to voluntarily cut its oil production by 1mbpd in February and March above its current quota and the news of a further fall in the United State’s supply of the commodity to the market, creating an artificial add-on to the cartel’s most recent cut. Considering Nigeria’s economic frailties amid the pandemic’s lingering impact, does this bode well for the country?

This year, the appropriation bill tagged “Budget of Economic Recovery and Resilience” was passed into law with total expected revenue for the 2021 fiscal year estimated at N7.99trillion (36.9% higher than the N5.84trn projected in the 2020 bill). Underscoring the projected revenue is an oil price assumption of US$40/ barrel and production of 1.86mbpd. The logistic concerns around the mass deployment of the coronavirus vaccines amid the rising number of cases and emergence of new strains have heightened the risk of another round of lockdowns globally. The consequent impact on oil prices might force the country into another round of economic crunch.

Examining the impact on the Nigerian economy, we think an above US$40/bbl Brent price remains healthy for the 2021 budget revenue projections which is critical to achieving the historic revenue numbers projected in an ambitious budget. However, we retain grave concerns on Nigeria’s external conditions and consequently, exchange rate. We think the prolonged weakness in oil prices would drag on export receipts and thus FX earnings. On the other hand, we note that an increase in oil prices will imply an increase in the price of petrol which may either mean a further upward adjustment in petrol prices or a return to the subsidy regime.

That said, we reiterate our agelong clamour for economic managers to adequately diversify the country’s export earnings particularly exploring opportunities in mining and agriculture. Furthermore, investments and business regulations to accelerate local industrialisation which would foster local production of many imported products would significantly help to reduce dependence on imported products and thus conserve scarce FX.

Recent Comments