This analysis is by Bloomberg Intelligence Equity Strategist Laurent Douillet and Bloomberg Intelligence Head of EM Equity Strategy Gaurav Patankar

Secular trends are key to capturing investment opportunities in emerging markets as they’ll account for 80% of the world’s GDP growth following a recovery from the pandemic. We see “premiumization” of consumption, wellness and technology as growth themes for well-established European companies among our five identified trends

Emerging-Markets exposure is a bonus

Exposure to emerging markets is a plus for European companies as our basket of 84 Stoxx 600 index members with more than 20% of sales to developing economies has steadily outperformed over the past five years. Those superior returns are mainly driven by stronger earnings growth as the forward EPS estimate of our basket has risen 41% since May 2016 vs. only 13% for the broader benchmark. The rerating of both indexes was about 20% and the P/E ratio of our basket is at a 16% premium to the Stoxx 600 (19.8x vs. 17.1x) vs. 11% five years ago.

Our aggregate is heavily biased toward consumer-related companies as they account for 48% of the weight, followed by materials (13%) and technology (11%). Financials and health care are underrepresented, with only 8% and 4%, respectively.

`Premiumization’ of consumption

One of the prevalent trends in emerging markets is the “premiumization” of consumption. As developing economies grow richer, consumption and spending patterns are shifting toward discretionary goods and services from basic necessities. We also see demand shifting to higher quality, premium brands in many product categories. The growing popularity of premium liquors is one well-established trend, but we also see this across a variety of groceries and personal-care products, as well as more expensive categories, such as autos and luxury goods.

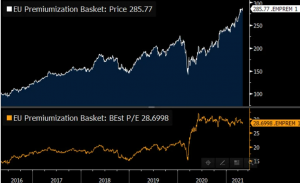

Among the 21 consumer-related companies in our basket, we identify 11 exposed to this trend, including LVMH, Kering, Hermes, Adidas or BMW. They’ve outperformed the basket (186% vs. 73%) over the past five years but come with a hefty price tag, with their forward P/E at 29x.

EU companies basket exposed to premiumization

Wellness market in EM is healthy

In a post-coronavirus world, we expect health and wellness to emerge as a key consumption pattern in emerging markets as government investments in health-care infrastructure will raise consumer awareness to the benefits of having a healthier life style. The most important product categories include personal care/beauty, nutrition, fitness and preventive medicine, which all offer growth opportunities to well-established European companies. With consumer surveys in emerging markets showing a preference for natural and more personalized products, EU companies will need to adapt their business model and be flexible to compete with local producers.

Nestle, Unilever, L’Oreal, Beiersdorf, AstraZeneca and Givaudan are some of the European companies to play this theme, with more than 20% of their sales in emerging markets.

EU health and wellness basket with exposure to EM

Enablers of technology adoption

The pandemic has forced broader technological adoption across emerging markets, as it has elsewhere. Though online consumption and services are dominated by Asian companies, the technology enablers — such as semiconductor and hardware companies — that support the rollout of online platforms, 5G networks and the development of AI-type applications are likely to play a crucial role. This will drive demand for advanced semiconductors and sensors as well as state-of-the-art hardware equipment.

This basket has the highest return, at almost 300%, due to the sharp rise in European semiconductors and equipment companies (ASML, ASM International, STMicro). It includes software companies (Hexagon, Aveva), as well as Prosus, but excludes the two telecommunication service companies with EM exposure (Telefonica, Telenor).

EU tech companies with exposure to EM (5-year return)

Recent Comments